Customer Analytics & Behavior Insights for Finance & Insurance

22% increase

in conversion rate for Curative by optimizing high-value flows with Mouseflow.

Read Curative's Story22% increase65% more form submissions

after mapping and refining user journeys for employer and broker audiences.

Explore the full journey65% more form submissions78% increase

in conversion rate for MEGABAD after reducing checkout friction.

Read MEGABAD's story78% increase

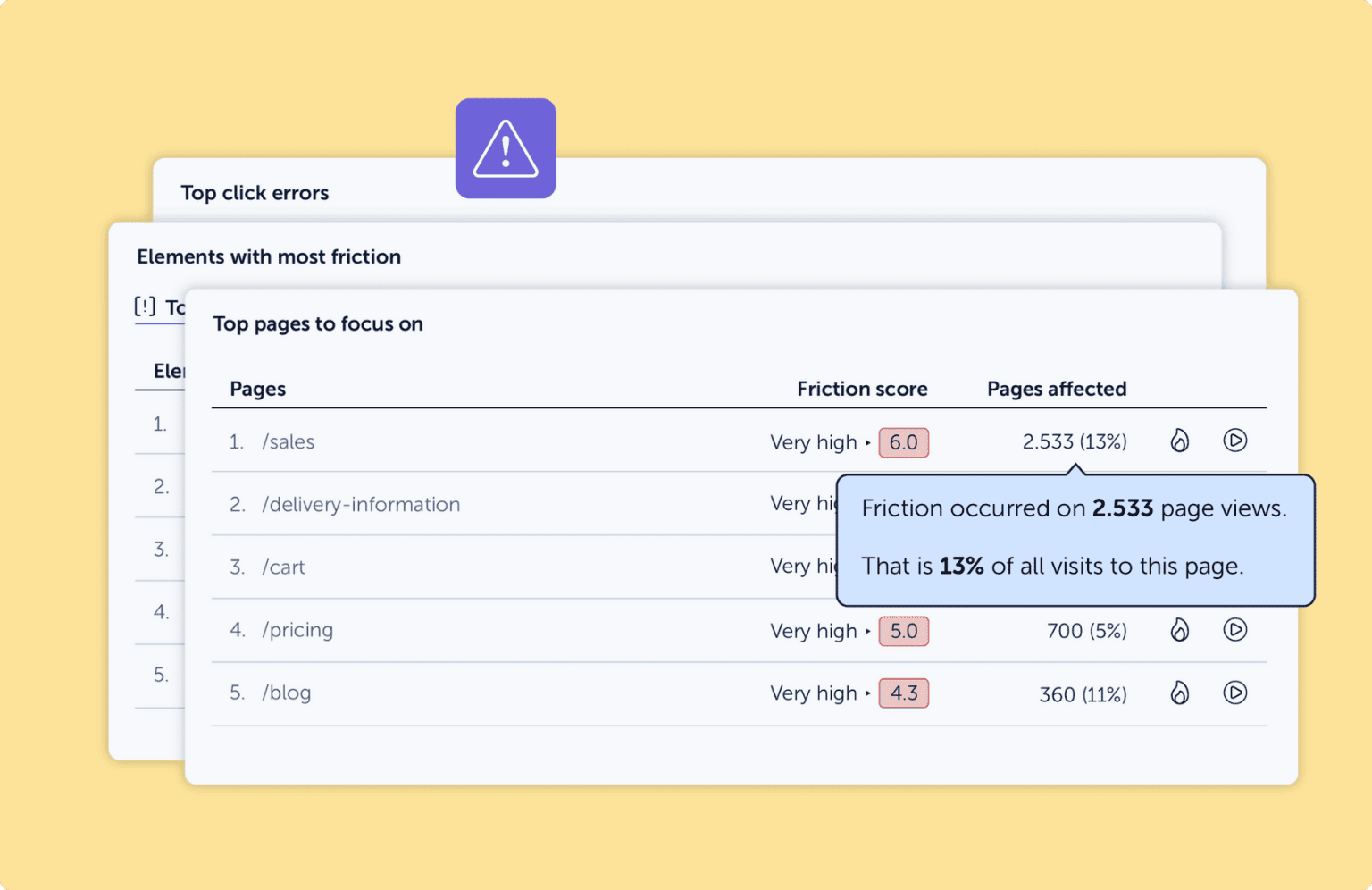

Spot friction where trust and revenue are on the line

When users apply for coverage, seek quotes, or compare financial products, confidence matters. If a page feels slow, overwhelming, or doesn’t feel secure, they leave without warning.

Mouseflow helps you identify the exact steps where users hesitate or abandon. Track behavior on pricing pages, sign-up forms, and logins to fix blockers before they hurt conversion. Whether it’s banking or insurance, trust starts with a great user experience.

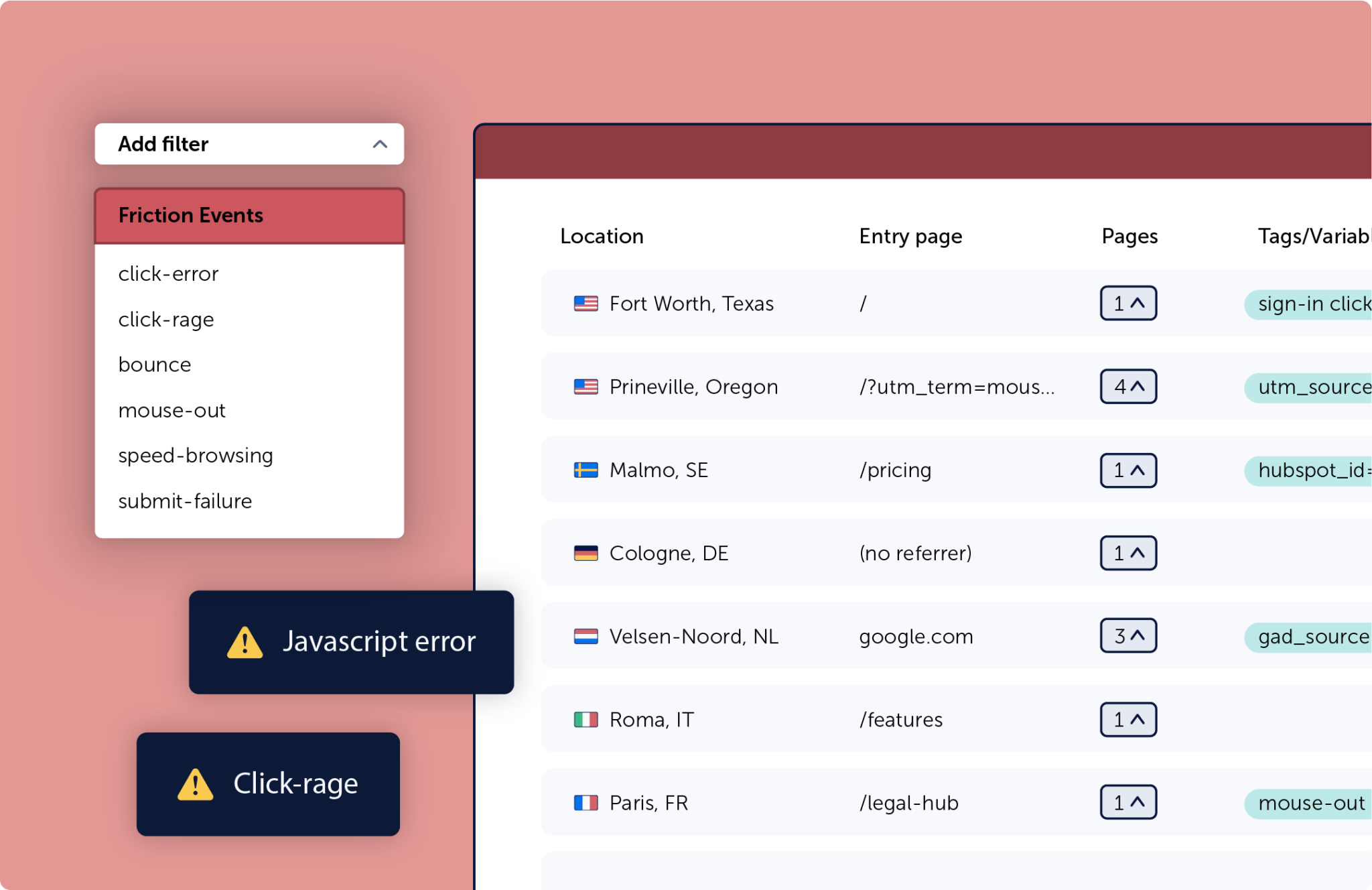

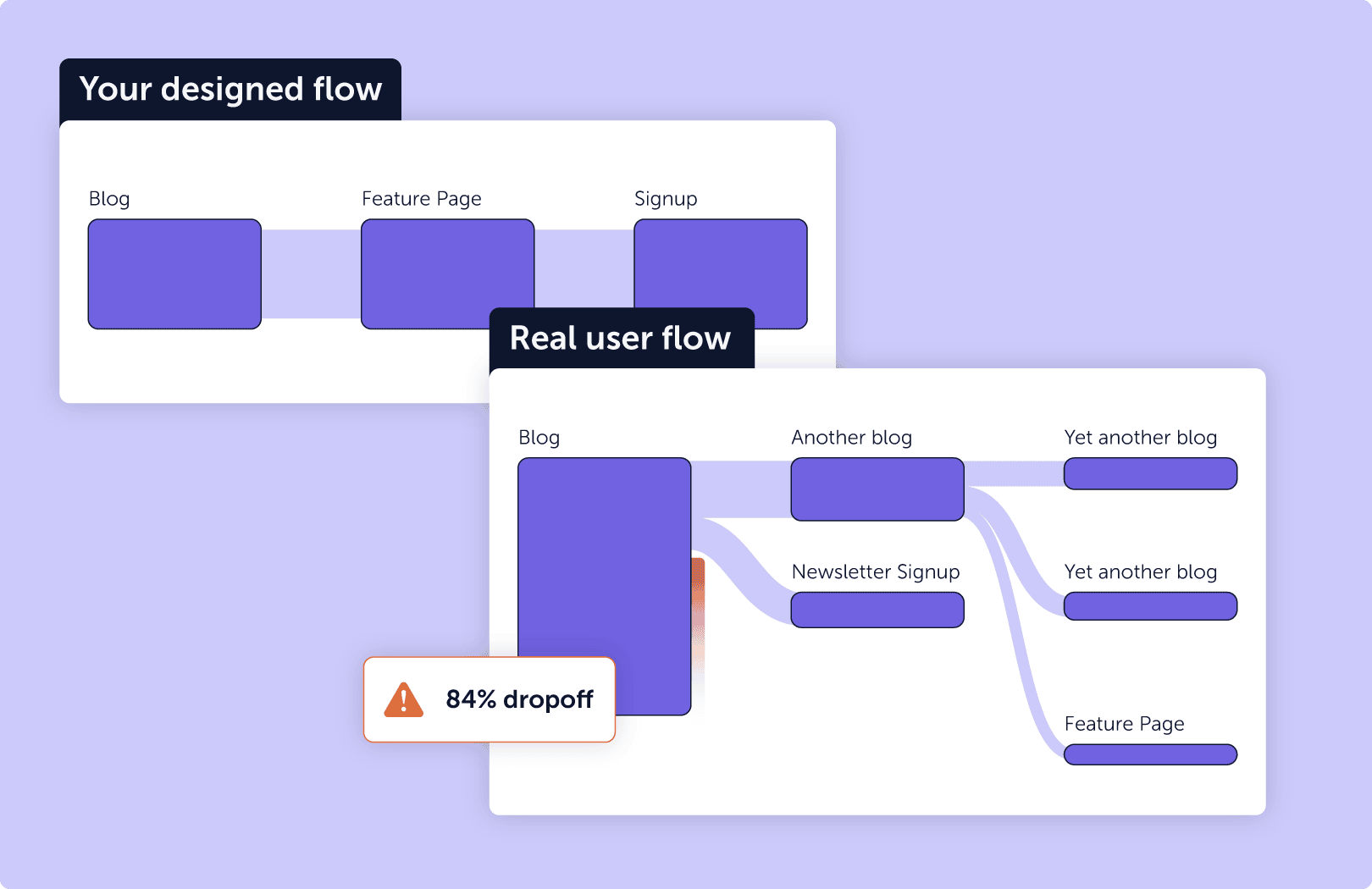

Map the full customer journey, not just isolated events

Behavior isn’t linear, especially on financial and insurance sites. Visitors jump between support pages, FAQs, and content before applying for a loan, requesting a quote, or opening an account. If you only look at isolated events, you miss the bigger picture which can quietly lower your conversion rate.

Mouseflow’s Journey Analytics helps you see how users navigate across touchpoints. With heatmaps, you can track scroll depth, engagement zones, and attention drop-offs. Find stale content, spot high-value articles, and support journeys with more intuitive linking. Your content strategy becomes not just informative, but action-driving.

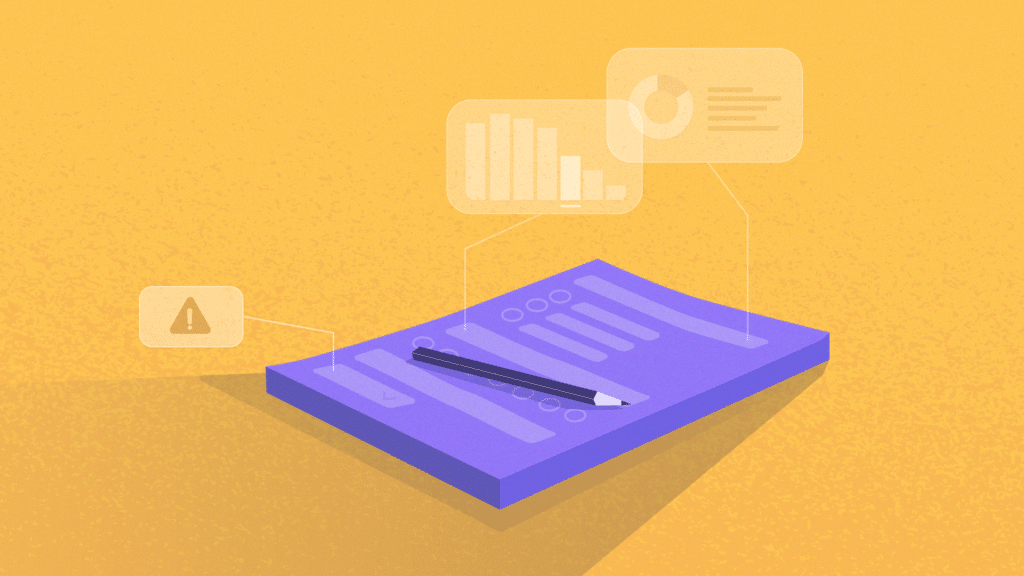

Get customer analytics without the complexity

You don’t need another dashboard. You need answers that drive action. Mouseflow provides visual, secure insights to understand how users interact with your site.

Whether you’re focused on insurance customer analytics or online banking UX, Mouseflow helps teams prioritize improvements that reduce churn, improve satisfaction, and support compliant digital growth.

Integrate with the other industry-leading software in your stack

Level up your finance & insurance company

FAQ

Mouseflow is a behavior analytics tool that shows how people interact with your website. You can watch session replays, view heatmaps, and track user journeys to understand where visitors get stuck or drop off. It helps financial and insurance providers improve pages like quotes, sign-ups, and pricing flows.

Yes. Mouseflow shows where users drop off or hesitate on critical forms, such as quote calculators or signup flows. This helps teams in banking and insurance reduce friction and improve conversion rate optimization and overall form performance across the site.

It reveals how policyholders and prospects behave across your website. These insights help teams optimize journeys, claims pages, and support portals, leading to higher engagement and conversion.

Google Analytics provides metrics while Mouseflow goes deeper by showing real user behavior. With session replays and heatmaps, teams in banking and insurance can uncover exactly what users are doing and why. This makes Mouseflow a better fit for customer analytics in banking and improving the user experience across insurance platforms.

Yes. Mouseflow’s Journey Analytics reveals how users move through your site, not just the pages they visit. It’s especially valuable for analyzing complex online banking user experiences or navigating lengthy insurance comparison flows, where understanding drop-off points and behavior patterns is critical.

Mouseflow tracks scroll depth, attention zones, and clicks – helping teams spot outdated or underperforming pages. With these insights, you can enhance support content, blog posts, and landing pages to boost user education and drive better results in finance website optimization.

Absolutely. You can segment traffic by campaign, keyword, or source to see which users engage or bounce. This enables better conversion rate optimization for financial services, helping you double down on high-performing campaigns and eliminate spend on traffic that doesn’t convert.

Yes. You can track how users interact with any element on your website. Mouseflow shows whether people complete them, where they get stuck, and if they leave before finishing.

Yes. Mouseflow lets you track how different audiences, like customers, brokers, or partners navigate your site. You can filter by user type, traffic source, or behavior to see how each group interacts, even when journeys are non-linear. These insights support banking customer analytics and help you tailor digital experiences for every audience segment.

Yes. Mouseflow offers privacy features such as keystroke masking and field blocking to support your compliance with the GDPR and US privacy laws. It can be safely used in regulated industries without capturing sensitive data. We also sign a DORA Addendum with Enterprise Customers subject to the Regulation.

Most teams are up and running in under an hour. Installation is simple – especially with platforms like Google Tag Manager – and Mouseflow starts collecting data immediately. That means faster insights for banking customer analytics and quick wins in website performance.