🎙 On the go? Listen to the article through our podcast, Cave Bits!

Listen to more episodes of Cave Bits

Update: This article has been updated in June 2024 to include the most recent best practices and share some of our own experience.

Competitor analysis (or competitive analysis – it’s the same) is a process of analyzing a business’s competitors, evaluating their marketing and development strategies, and finding new business opportunities.

Competitor analysis helps businesses refine their own strategies. it pinpoints underserved areas of a niche or industry and provides incentives for brainstorming and business planning.

What you can learn from competitor analysis

It’s worth competitor analysis on a regular basis, because there’s a lot of very valuable information you can obtain from this process.

- Information about your own product’s strengths and weaknesses – to fuel your product strategy.

- Strengths and weaknesses of specific competitors – to position the product against them.

- A general understanding of the market and its trends – to inform development and marketing strategies.

- The wants and needs of potential customers – to offer a more competitive product with the right messaging to them.

- And more – from looking into keyword gaps all the way to anticipating their reactions to your actions.

So let’s take a deep dive into how competitor analysis can help you in 2024, how you can best execute it to your advantage and without overspending your resources.

Choose them wisely

In order to truly benefit from the competitor analysis, you need to carefully choose the businesses you will be examining. Choosing a competitor you can’t actually compete with can cause a lot of frustration and unnecessary waste.

Make a varied list of competitors to start with, including both the top names in your niche, brands who are doing just a little bit better than you are, and those who are trying to catch up to you.

You can base your list on current search engine rankings, as it will be the easiest to track. But beware of picking too many indirect competitors this way. Or you can devise your own system, based on real-world facts you are already familiar with.

The key is to populate your list with a wide range of competitors and to have a specific reason for choosing all of them. If you don’t understand how they are competing with you or why, leave them out. By the end of this exercise, you’ll have a list of brands and a general understanding of the competitive landscape.

You can then narrow down the list later, so that you only have direct competitors in the there and avoid the problem of trying to run against a business you couldn’t really compete with.

Direct competitors vs indirect competitors

A direct competitor is a business that offers the same product to the same target audience.

An indirect competitor is a business that offers a product that theoretically can substitute or replace your product.

To give examples: Nike and Adidas are direct competitors – they offer similar products to similar audiences. If we consider Nike’s indirect competitors, it could be Vibram, for example. They also produce running and training shoes, which can substitute Nike’s shoes. But they aim at a different audience, much more narrow and educated, while Nike is a mainstream brand.

Context matters

The thing with direct and indirect competitors is that it depends on the context. For example, when you’re considering the competition from the content marketing perspective, the product may not necessarily be your main offering, but the content that you create.

In this case, direct competitors are brands that offer similar content aimed at the same target audience. Indirect competitors are those that perhaps aimed at a different target audience, but ended up next to you on the search engine result page (SERP).

If we go back to Nike’s example, when creating content about running, they may end up competing with brands like Fitbit or Garmin, that do not produce shoes at all, but also create content about running gear.

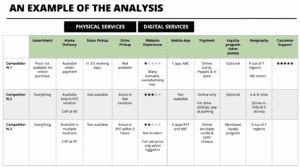

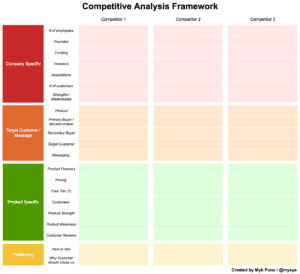

Figure out what you want to compare

You then want to figure out what you will be comparing. There will certainly be some intangible impressions you can’t quantify that you should. However, in order to have the most value and sense, you need to identify some key metrics that you will use to measure one brand against the other.

While this list is by no means exhaustive, here are some of the metrics you should consider using as your performance indicators when it comes to digital marketing strategies:

- Rankings for common keywords

- Keywords unique to a competitor you could utilize yourself

- Social media mentions

- Number of followers

- Engagement per post

- Social media ad keywords and targeting

- Influencers they work with

- Backlink profile quality

- Rate of backlink acquisition

- Customer reviews on third-party sites

- PPC campaign keywords

- PPC campaign targeting

- Voice and branding

- Blog post topics

- Rate of publishing new content

- Content promotion channels

There may of course be other metrics you want to keep an eye on, depending on your niche.

You may want to skip a fair few of these as well: there is no need to analyze every single aspect of a competitor’s business, unless you are actively trying to compete for a specific share of their market and audience, or if you are just building your business from scratch.

Find an easy way to keep track of data

Having identified the metrics you want to analyze, create a sheet either in Google Sheets or in Excel that will house all of this information.

You can also download a competitive analysis template and tweak it to your needs if you don’t want to build your own competitor analysis process. It can also help you identify some further metrics you want to take note of.

Make sure that the sheet is easy to use for you: as long as all the people who need to understand it find it clear and easy to follow. You don’t need to worry about how other companies have structured theirs.

Your main objective is to have a very clear overview. List your competitors in order of importance, and don’t forget to add in your own data as a benchmark!

Examine their website

Before you start looking at the way a competitor is promoting their business and driving traffic, you should take some time to analyze their website.

Examine their website layout and how easy to navigate it is. Take a look at the design and the color story they have chosen. How good is the overall customer experience on their website?

Read through their main page and sales page copy, and pinpoint their key selling points, and what their appeal is. What do they blog about, and how do these topics fit into their overall marketing strategy?

You will need to put your thinking hat on for this step, as there are very few metrics and tools that can help you. You need to make some logical conclusions and reach your own discoveries.

You will also want to monitor website changes regularly, to see what a competitor is updating and when, and determine what the results of these changes are. Are they growing or stagnating?

Doing competitor website analysis regularly allows you to stay up to date with the latest market trends.

Look at the bigger picture

Competitor analysis is not just about looking at someone’s website, backlinks, or keywords. You need to take the big picture into account if you are true to gain valuable insight.

For example, a competitor might have a really outdated website, but they may run a radio ad that gets them a lot of traffic. Or they may be doing some guerrilla marketing in their area and get a lot of foot traffic that way.

Visit your competitor’s store or premises, check them out on social media, google their brand name, speak to their customers to see what the end-to-end experience is like. This will help you see the big picture and discover exactly what gives you that competitive edge you are looking for.

For instance, if a competitor has awful customer service, you can make this your selling point, and pick up a lot of their frustrated customers.

Take a look at their pricing model

To ensure you are truly competitive, compare others’ prices to yours. Determine how their products and services differ from what you are offering, and what their main selling points are.

If your product or service is better than your competitors’, you’ll be able to justify a higher price. But if it is inferior or just the same, don’t expect to get away with it: customers and clients are quite savvy in finding the best deal. If they feel they are being ripped off they won’t be doing any business with you.

The time you invest in competitive pricing analysis will be worth your while, as you can discover some significant room for improvement, and alter your prices if necessary.

Test their product or service

You’ll also need to do some real-world analysis too and actually do business with your competitor – if possible. Make a purchase, try out their free trial, or hire them to perform a service. This will provide heaps of first-hand information you can’t access any other way.

If you don’t want to do this yourself, ask a friend or family member to do the research for you. Make sure they take meticulous notes of the entire process and report back.

This is the kind of data that can give you the sharpest edge, as it takes a fair amount of effort to gather, and most businesses won’t want to take the time to gather it.

Evaluate customer reviews

After you’ve seen their product and gotten an impression, take a look at the customer reviews to see if their actual customers have something else to say.

Head over to review sites. For B2B products, we suggest G2 or Capterra.

For B2C, that could be Yelp, their profiles on Google Maps, maybe the reviews on Amazon if they sell there, or in the Apple Store if they offer apps.

Look for pros and cons that their existing customers mention and try to find patterns, as well as compare them with your own experience.

A lot of people say a certain product is slow? You just gained a competitive positioning against them.

People don’t like the quality of support? There you go, here’s another competitive advantage.

We did a lot of that when preparing our article about the best session replay and heatmap tools. We tried the products wherever we could, and we also went through a lot of customer reviews to understand what strengths and weaknesses customers see in our competitors’ products.

How we do competitor research and what tools do we use

There’s a lot of competitor analysis tools that can fetch most of this data for you.

Here’s a list of some of the competitor analysis tools that we use:

- Semrush – for SEO competitor analysis.

From Semrush, we get the keywords our competitors rank for, their backlinks profile, the content gap that Mouseflow has with them, etc.

Semrush makes it almost as easy as selecting “Domain overview” there and pasting your competitor’s domain!

- Mention – that’s a great competitor analysis tool when it comes to social presense.

We track both our mentions and mentions of our competitors with it. It gives us an idea of what our competitors are up to in terms of marketing efforts, and also sometimes highlights conversations on platforms like Reddit in which we could participate.

- Confluence – our go-to tool for storing all the information about our competitors, so that other team members can access it.

- Loom – when we try out competitors’ products, we record demos.

- G2 – our competitors have profiles there, so we regularly review what changes there and what their customers mention in their reviews. Because every their current customer is our potential customer. Overall, G2 is a great tool for market research.

Final thoughts

These competitive analysis tactics will help you discover what your competitors are truly made of, and help you improve and develop the kinds of products and services that will put you on your niche map.

Remember that research without implementation is useless, so act on the data you discover as soon as possible.